The 2025 deadlines for NZ’s two R&D tax credits are fast approaching. Many NZ businesses can still claim R&D from the 2024 tax year. Let’s see how.

What R&D Funding is Available?

If your business isn’t yet claiming tax credits to offset your Research and Development (R&D) expenses, make 2025 the year you take the plunge. With possible cash refunds of between 15% and 43% of your R&D expenses, you don’t want to miss out.

New Zealand offers tax credits and cash refunds for your R&D activities through two separate programs:

- 15% of costs - R&D Tax Incentive (RDTI)

- 28% of costs - R&D Loss Tax Credit

Most private-sector NZ businesses who conduct R&D can access the RDTI. If the business also makes a loss in the tax year, they may also be able to access the R&D Loss program. Your business can be eligible for both at the same time, giving up to 43% benefit.

Some businesses who don’t yet pay tax have hesitated to apply for any kind of tax incentives. However, both these programs can deliver annual cash refunds, even if you have no tax to pay in the year.

Both these programs remain open even with the recent changes to New Zealand’s science sector.

Major NZ R&D Tax Credit Deadlines

For most businesses your tax year ends 31 March, and these deadlines will apply:

30 Apr 2025* - Apply for 2024 R&D Loss Tax Credit

30 Apr 2025* - Claim 2024 RDTI (if you have a General Approval already)

30 Jun 2025 - Apply for RDTI General Approval (if needed)

6 Aug 2025** - Apply for 2025 R&D Loss Tax Credit

6 Aug 2025** - Claim 2025 RDTI (including 2024 ‘supporting’ expenditure)

*Assumes you have a tax agent or standard ‘extension of time’

**These dates apply if you have no tax agent or extension of time

How to Claim R&D Tax Credits from the 2024 Tax Year

For many NZ businesses on a 31 March tax year, it may still be possible to claim for R&D done in the 2024 tax year. This happens when you have an ‘extension of time’ for filing tax returns, which is standard for every business who has a tax agent. It doesn’t matter whether you have already filed that tax return or not.

This means your R&D expenditure back to 1 April 2023 may still be claimable.

Did you make a loss?

If you reported a loss in the 2024 year, your deadline for claiming 2024 R&D expenditure from the R&D Loss Tax Credit is 30 April 2025 (under extension-of-time arrangements). You can also claim 2024 costs via the RDTI as for a profitable business (below).

Did you make a profit?

If you reported a profit in the 2024 year, you may still be able to claim some costs from the RDTI. You will first need to submit a general approval application by 30 June 2025. This describes how your work meets the definitions of R&D for RDTI. As part of this process, you can seek approval for ‘supporting’ work that was done in the 2024 year. When the application is approved, you can them claim the relevant 2024 costs alongside your 2025 claim.

How to Claim R&D Credits for the 2025 Tax Year

Most qualifying businesses can still claim R&D credits for the 2025 year, regardless whether you have an extension-of-time to your tax deadlines.

If your business will report a 2025 loss, you have until at least 6 August 2025 to apply for the R&D Loss Tax Credit, assuming they are on a 31 March tax year. That date shifts according to your tax filing dates, but is always 30 days after the tax return is due.

For all businesses, your 2025 RDTI claims are due at the same time, but you must first seek general approval of your activities by the 30 June 2025 date.

How Long Should I seek RDTI General Approval for?

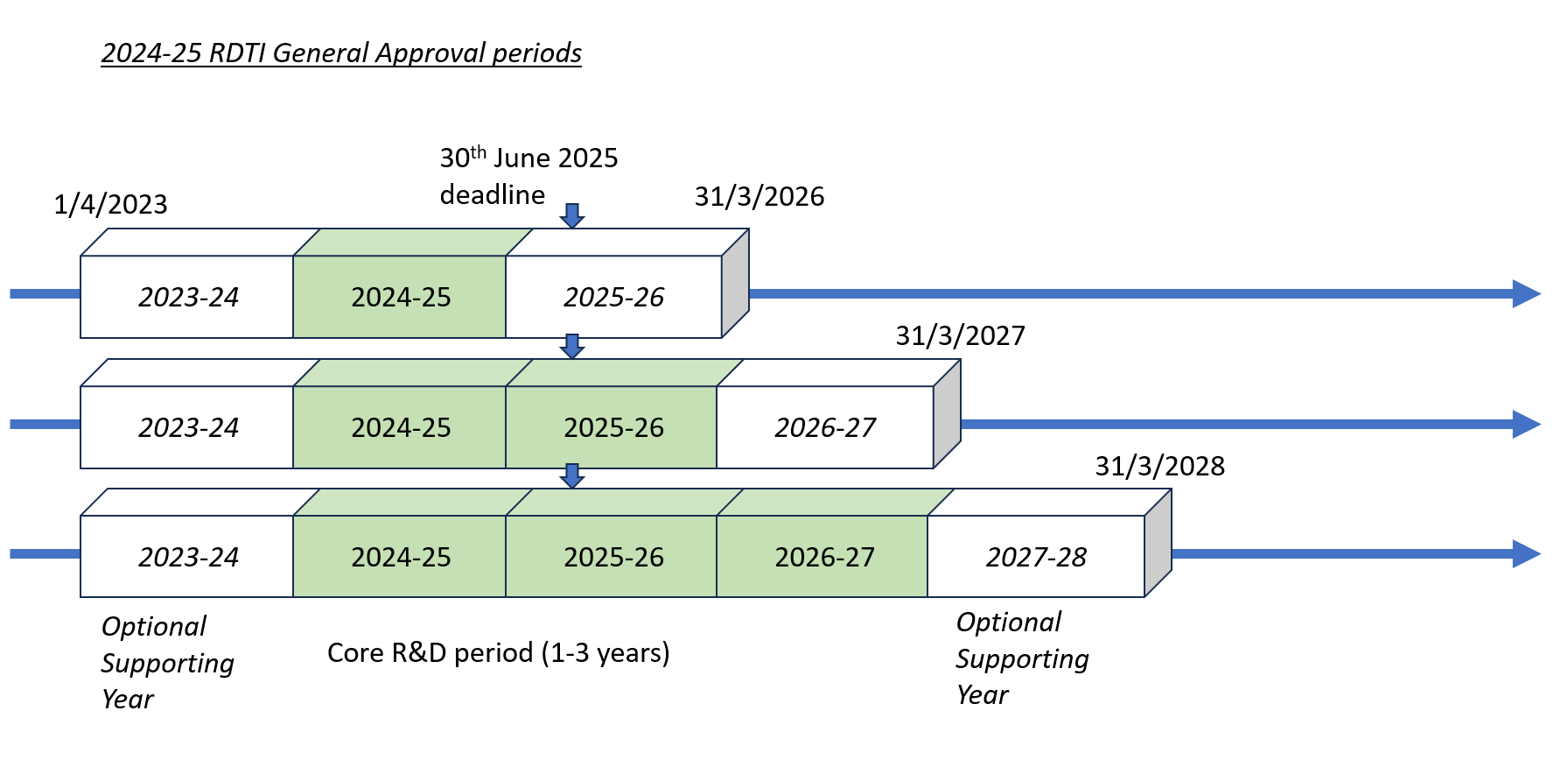

An RDTI General Approval can remain valid for one, two or three tax years. To get the maximum approval, you can apply for the ‘core’ R&D completed in the current year, and that expected to be completed in the next two years.

The general approval can also cover ‘supporting’ R&D activities conducted one year earlier and one year later than your core R&D, making for five tax years in total. This means if your business runs on a 31 March tax year, and you seek approval before 30 June 2025, you could receive approval for the 2024 – 2028 tax years, covering expenditure from 1 April 2023 to 31 March 2028.

Be warned - don’t miss the 30th of June deadline, or your dates will shift a year later. This is because only approved R&D activities can be claimed for.

"I’m a Big Spender. Do I still need a General Approval?"

If your business expects over $2m in R&D expenses per tax year, you can apply for ‘Criteria and Methods’ approval instead of General Approval.

In practice, because the Criteria and Methods assessments involves extra work at application time and at the end of each tax year, it's likely you'll still prefer the General Application route. Get in touch with our R&D consultants if you wish to discuss your specific situation further.

How Do I Get Started with RDTI & R&D Loss Credits?

If you want to DIY then your first step is to digest the IR1240 and the relevant sections of the Income Tax Act 2007 and the Tax Administration Act 1994 .

Before you assess your eligibility, we recommend gaining a good understanding of the regulatory framework to avoid wasted time and non-compliance.

If wading through tax law is not your cup of tea, then reach out to one of our grant advisors today. BlueRock offers:

- high-quality advice regarding eligibility

- full-service preparation of your applications

- assistance in dealing with regulators

- accurate calculations of your R&D expenditure, and

- support with your end-of-year claims.

You 2025 R&D credits? Sorted!

Key resources available: